Financial ratios or accounting ratios are most commonly used by every businesses and companies to determine or evaluate the overall financial health of the business and companies. These ratios are frequently used by financial analyst, managers, shareholders, creditors to find out about the strength and weaknesses of the any organization.

Financial ratios or accounting ratios are most commonly used by every businesses and companies to determine or evaluate the overall financial health of the business and companies. These ratios are frequently used by financial analyst, managers, shareholders, creditors to find out about the strength and weaknesses of the any organization.

The data used in calculating financial ratios comes from either income statement, profit and loss account, cash flow statement or company balance sheet. These financial ratios allow the companies to compare its financial strength between companies, industries, different time period for one company. These rations are measured always against benchmark set by a company. Without benchmark, these ratios are not so useful. Company have to have some kind of industries benchmark set to compare against its financial ratios.

Most publicly traded companies are required by law to use generally accepted accounting principles (GAAP) for their home country. However, the private companies such as LLC, partnership, private companies are not required to use GAAP method.

There are primarily four main categories of financial ratios that all business used to analyze its data:

- Profitability Ratios

- Liquidity Ratios

- Debt Ratios

- Activity Ratios

Let’s elaborate further about all the above financial ratios:

1: Profitability Ratios: These ratios allow companies to measure its ability to make adequate return on sales, total assets and invested capital. In other words, these ratios measure how effectively a company utilizes its resources. Some of the profitability ratios are as follows:

Profit margin ratio: profit margin ratio is calculated by dividing the net income by sales over a reporting period. For example: if company earns net income for $25,000 in a reporting period and its sales amounted to $250,000, the profit margin ratio can be calculated as follows:

Profit Margin Ratio: Net Income/Sales

Profit Margin: $25,000/$250,000

= 10%

Return on Investment Assets: Return on investment can be arrived by dividing the Net Income by Total Assets. For example if company Total Assets are $200,000, its return on assets ratio will be as follows:

Return on Assets: Net Income/Total Assets

ROI: $25,000/$200,000

= 12.5%

Return on Equity: Return on equity ratio is calculated as dividing the Net Income by Net equity. In other words if company Net equity is worth at $100,000, its Return on Equity ratios will look like as follows:

Return on Equity: Net Income/ Net Equity

= $25,000/$100,000

= 25%

Gross Margin Ratio: Gross Margin Ratio can be calculated by dividing the Gross profit by Net Sales. For example: If company gross profit is $50,000 and its net Sales are $250,000. The Gross Profit Margin ration will look like as follows:

Gross Profit Margin Ratio: Gross Profit/ Net Sales

= $50,000/$250,000

= 20%

2.Liquidity Ratios: Liquidity ratios determined the company ability to pay it short term obligations normally due within 12 months. There are mainly four liquidity ratio that business or companies would like to find out if they have enough cash to pay its short term debt:

Current Ratio: Current ratio is also known as working capital ratio. The current ratio is calculated by dividing the current assets to current liabilities. For example: If Company net current assets are $150,000 and its net current liabilities are $75,000, The company current ratio will look like as follows:

Current Ratio: Current Assets/ Current Liabilities

= $150,000/$75,000

= 2 Times

Quick Ratio: Quick ratio is calculated by subtracting Inventory from Current Assets divided by Current Liabilities. For Example: Company Inventory in hand at the end of reporting period amounted to $75,000.

Quick Ratio: Current Assets-Inventory/ Current Liabilities

$150,000-$75,000/$75,000

= 1:1

Cash Ratio: Cash ratios are calculated adding Cash and Marketable Securities divided by Current Liabilities. For Example: If company balance sheet shows cash in hand equal to $100,000 and Its marketable securities on books amounted to $50,000, the its cash ratio should look like this:

Cash Ratio: Cash + Marketable Securities/ Current Liabilities

$100,000 + $50,000/$75,000

= 2 times

Operating Cash Flow: Operating cash flow ratio is calculated as dividing the Operating Cash Flow by Total Debts. For example: company operating cash flow shows $150,000 and Total debt shows $75,000, its operating cash flow ratio should look like this:

Operating Cash Flow: Operating Cash Flow/Total Debts

$150,000/$75,000

= 2 Times

3. Debt Ratios: Debit ratios are also known as leveraging ratios. The ratio is defined as the ratio of total debt to total assets expressed as percentage. These ratios can be interpreted as the proportion of total company’s assets that are financed by company’s debt. The higher of these ratios represent that the company is more leveraged with its debt associated with more financial risk. There are mainly four debt ratios Companies would like to know:

Debit Equity Ratio: Debt equity ratio represent the shareholders equity and the debt used to finance company’s assets. The debt equity ratio can be interpreted as proportion of long term debt plus Value of Leases divided by Total Assets.

Debit Equity Ratio: Total Liabilities/ Shareholder Equity

For Example: If a company has its total liabilities of $200,000 and total shareholders’ equity of $800,000. Its debt to equity ratio will look this:

Debt Equity Ratio: $200,000/$800,000

= .25

Total Debt Ratio: Total debt ratio represent the company total liabilities to total assets. The lower the ratio means the company is less dependent on its leverage. In other words, the higher the ratio, the more risk company is taking.

For Example: Let’s assume company total assets at the end of reporting period amounted to $900,000 on the balance sheet. So the total debt ratio will look like this:

Debt Ratio: Total Liabilities/Total Assets

Debit Ratio: $200,000/$900,000

= 22%

Interest Coverage Ratio: Interest coverage ratio is commonly used by companies to determine if it can pay interest expenses on its outstanding debt. The ration is calculated by dividing the company earnings before interest and taxes (EBIT) by the total interest expenses. The lower the ratio, the more the company is burdened by its debt expenses. The ratio of less than 1.5 is considered risky as company ability to pay interest expenses will be questionable.

For Example: ABC LTD has its earnings before interest and taxes amounted to $200,000 and Interest expenses amounted to $28,000.

Interest Coverage Ratio: Earnings before Interest and Taxes/ Interest Expenses

Interest Coverage Ratio: $200,000/$28,000

= 7.14

This represent that the company has good margin of safety to cover its interest expenses.

Cash Flow to Debt Ratio: The cash flow to debt ratio is calculated by dividing the company operating cash flow by total debit. The ratio tell the business owner if they have the ability to cover their debit from its operating cash flow earning. The higher the ratio is, the chances that better the business owner to carry its total debt.

For Example: The Company ABC Ltd. have total operating cash flow amounted to $100,000 and its total debt at the end of reporting period are $130,000. The cash flow to debt ratio will look this:

Cash Flow to Debt Ratio: Operating Cash Flow/Total Debt

Cash Flow to Debt Ratio: $100,000/ $130,000

= .77

4. Activity Ratios: Activity ratios are those ratios that all business owners like to know if they have the ability to convert different accounts of balance sheet in to cash or sales. These ratios widely used to measure the relative efficiency of a company assets, leverage or other balance sheet items. There are mainly three activity ratios that businesses would like to know:

Stock Turnover Ratio: Stock turnover ratio can be calculated by dividing the cost of goods sold by average inventory. Generally the stock turnover ratio can also be calculated by dividing the sales by Inventory. A low turnover is normally considered a bad sign because products value tend to deteriorate as they sit in the warehouse for longer than average period of time.

Stock Turnover Ratio: Sales/ Inventory

OR

Stock Turnover Ratio: Cost of Goods Sold/ Average Inventory

For Example: If a company shows its sales at the end of reporting period amounted to $500,000 and its inventory shows total to $200,000, then stock turnover ratio should look like as follows:

Stock Turnover Ratio $500,000/$200,000

= 2.5

Assets Turnover Ratios: Assets turnover ratio is calculated by dividing the sales or Revenues by Total assets. Generally speaking, the higher the ratio, the better it is as company generating more revenue per dollar of assets.

For Example: ABC LTD. has total sales at the end of reporting period amounted to $500,000 and its total assets appears on balance sheet at the end of reporting period amounted to $750,000. Then assets turnover ratio can be calculated as follows:

Assets Turnover Ratio: $500,000/$750,000

= 67%

Inventory Conversion Ratio: Inventory conversion ratio is calculated by total inventory to cost of sales divided by 365. The inventory conversion is measured as against the time required to acquire raw materials for a product, manufacture and then sell it.

Inventory Conversion Ratio Inventory/Cost of Sales/365

In addition to helping management and owners of business in diagnosing the financial health of their company or business, ratios can also helpful for managers to make decisions about investments or projects that the company is considering to take, such as acquisitions, or expansion.

Still confused or need to brush up your knowledge on financial ratios? Connect with our Online Accounting Tutor and get the help right away.

Every business owners, company investors and board of directors would like to see how their company performing financially. A need for preparing financial statements becomes a routine part for any organization. These financial statements tell business owners, companies board of directors a true picture about the health of their organization. Therefore, interpreting and understanding these financial statements becomes important on the part of investors, owners and companies board of directors.

Every business owners, company investors and board of directors would like to see how their company performing financially. A need for preparing financial statements becomes a routine part for any organization. These financial statements tell business owners, companies board of directors a true picture about the health of their organization. Therefore, interpreting and understanding these financial statements becomes important on the part of investors, owners and companies board of directors.

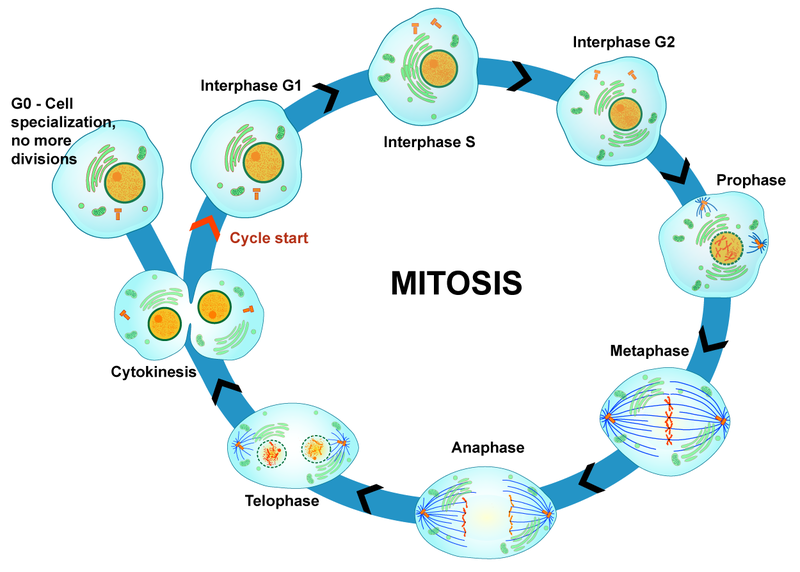

Mitosis

Mitosis